Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

Underwriting sits at the heart of life insurance, determining who gets coverage, at

what cost, and under what conditions. Over the past two decades, life underwriting

departments, have moved from paper applications, physician statements and

manual labs toward rule-based engines that drive dynamic questionnaires and

integrate third-party labs. This evolution slashed cycle times and boosted

consistency, but it also uncovered new frontiers where rigid “if-then” logic can’t keep

pace with exploding data sources and customer expectations.

AI powered underwriting introduces real time decision making, data driven risk

assessment, and greater personalization. It draws on vast pools of structured and

unstructured data, including electronic health records, wearable data, pharmacy

databases, and even behavioural insight, to deliver faster, fairer, and more dynamic

underwriting decisions.

For consumers, this means quicker access to cover. They require instant access to

quotes, and digital onboarding. For insurers, it unlocks operational efficiency, deeper

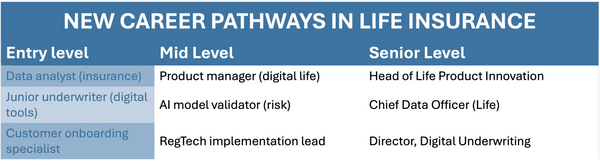

customer insights, and more precise risk segmentation. The shift is transforming intelligent processing of information away from the consumer, back towards the designers and strategists creating insurance processes. This migration of complexity is creating new demands in the insurance industry giving rise to new roles.

With AI handling data collection and initial risk scoring, human underwriters

will shift focus to more complex cases, judgment calls, and strategy. They will

analyse AI-generated insights to design innovative products and manage

emerging risks.

Insurance companies will increasingly rely on data scientists, machine

learning engineers, and AI ethicists to build, maintain, and audit underwriting

models. These professionals ensure AI systems are accurate, fair, and

compliant with regulations.

With underwriting accelerating, customer-facing roles will focus more on

education, advising clients, and handling sensitive cases that require empathy

and nuanced communication.

New roles will emerge to oversee AI governance, transparency, and bias

monitoring, ensuring that AI decisions are explainable and meet ethical and

legal standards.

Teams will focus on integrating AI systems with legacy platforms, data

security, and continuous improvement rather than manual processing.

The shift in role demand reflects the shift in complexity, away from complex case processing towards finding patterns in data that are useable, explainable inline with compliance regulations.

AI tools can extract relevant health, demographic, and behavioural data from

electronic health records, credit reports, and other sources, reducing the need

for invasive questionnaires or medical exams.

Machine learning algorithms can assess an applicant's risk profile with greater

nuance than traditional actuarial models. These tools continually learn from

claims outcomes to improve underwriting accuracy.

AI underwriting platforms can offer decisions in real time for simple cases.

This supports "instant issue" policies, especially for younger or healthier

applicants.

Insurers can now incorporate data from wearables, fitness apps, and lifestyle

surveys to assess risk dynamically, rewarding healthy behaviours with lower

premiums or additional benefits.

Responsible AI models can be audited to reduce historical biases based on

age, gender, or socioeconomic status promoting more equitable access to

insurance.

Obtaining an instant quote for a healthy individual for Life Insurance is not an

issue. Being able to provide a quote for an individual with Multiple condition

using unstructured data requires Gen AI. By integrating Gen AI into the quote

engine, insurers remove friction at the very first touchpoint.

AI empowers insurers to be faster and smarter, but it also demands a more skilled, cross-functional workforce that blends technology expertise with human insight. AI isn't replacing humans in the Life Insurance Industry, it's redefining value, changing the pattern of skills for the future inline with the shift in complexity of work, creating opportunities for customers and new demands for industry professionals.

Get in touch today to discuss how to navigate the industry changes.

Colm Kennedy is Principal and Managing Director. He leads digital strategy development teams to put clients on a path towards their strategic goals.

He has over 20 years experience leading 100 + Insurtech, Fintech, digital transformations. He has led underwriting, data , claims, AI, trading and fund management systems to market leader. Holding positions from COO, CPO and CEO.

Colm holds a B.Eng, Post Grad Dip Applied Computing, and M.B.A. from UCD.

Phil Daly is principle Underwriting Strategy Lead. With over 20 years of experience in the Life Insurance industry as an Underwriting Manager, she brings deep expertise in underwriting strategy, risk assessment, and process optimization. In addition, her 15 years in the IT industry have allowed her to bridge the gap between traditional underwriting practices and cutting-edge digital transformation. She has successfully guided insurance companies by integrating their underwriting strategies into comprehensive digital solutions, ensuring seamless end-to-end processes with third-party integrations that enhance efficiency, accuracy, and user experience. Her work enables insurers to leverage data-driven insights and automation, ensuring smarter underwriting decisions and improved business outcomes.